Market Report

The Future of Flexographic Printing to 2023

Smithers identify six trends that are helping suppliers meet expectations in the evolving flexographic printing market.

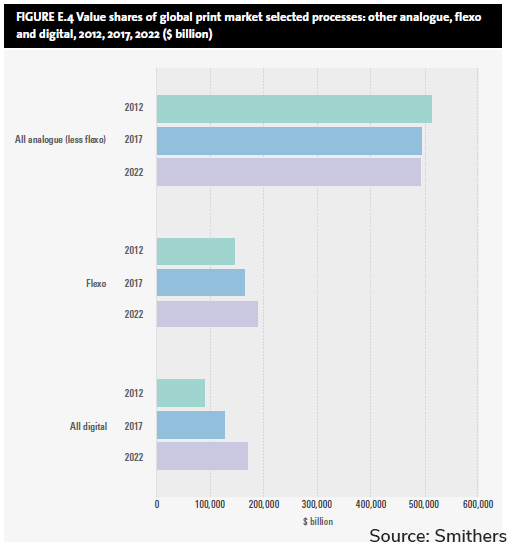

According to The Future of Flexographic Printing Markets to 2023, the flexographic printing market was valued at $164 billion in 2017. This is forecast to grow 2.3% annually, rising to a value of $187 billion by 2023.

Flexographic print has long since established its place as a print process of choice for many market sectors. However, the global print marketplace is changing rapidly with new consumer, retailer and client demands requiring more variation and lower run lengths. This is challenging the print supplier to implement advances in flexographic technology. These new technologies are improving efficiency and allowing suppliers to meet expectations within a volatile marketplace, facing increasing competition from digital (inkjet and toner) print and declining volumes in many traditional markets.

Smithers exclusive research outlines six trends that are changing the shape of the flexographic printing industry.

The flexographic process has often been reliant on skilled operator engagement to deliver quality results. New advances however, see the emergence of collaboration between OEM’s at every stage of the flexographic process. Driven by the improvements in process, make ready, and plate preparation – and hence turnaround especially on lower run work automation is increasingly a trend for flexo presses. Manufacturers are looking at all areas, from file preparation to print and finishing, to deliver an almost fully harmonious solution for operators.

A further key growth, resulting from technology advancement, is the extended fixed colour palette to a near full pantone equivalent. Using fixed colours minimises plate and ink changeovers, reduces waste and offers a consistency between productions.

Increased automation also helps address the problem of skilled labour – especially in developed regions. The flexographic industry as a whole has been slow to react to this problem as skilled press operators retire from the workforce and it has been difficult to attract and retain younger talent.

OEM’s are in fact leading the way for the flexographic industry, by evolving process and print production to digitise and automate many of the key flexographic functional requirements. The result has created far more intelligent and automated workflows and production with less emphasis on operator interaction and knowledge. While the initiative may reduce the volume of personnel required, it will certainly stem the major problem facing the industry overall.

The continued emergence of digital print into some of flexographic’s traditional core markets is driven by trends in lower volumes and personalisation options. As digital technology continues to evolve, the competitive volumes are constantly being challenged. Although flexographic remains a tried and trusted process for a wide range of materials, digital developments will see their range widen also.

There are obvious benefits of digital, which flexographic and OEM’s are embracing, by offering both options as standalone solutions. We have also seen a transition into hybrid print units. This combination of flexo and inkjet printing has a solid future in the industry.

Some traditional markets for flexographic production are in decline, none more so than newspapers. The market is seeing a clear shift in demand in its core global regions. Other printed goods witnessing declining volumes are envelopes, bags and sacks. All three are suffering from the effects of a shift in demand, both in consumer habit for alternative pack formats, and the preference for more electronic media.

The packaging sector represents flexographic’s core activities and volume. It is here where changing consumer habits have added the pressure on the industry. Flexographic is expected to adapt to lower volume run requirements and provide efficient changeover processes.]

Asia is now the dominant market in packaging markets and continues to grow with its developing population and economy. There is a surge of activity around consumer goods as economic growth forges a more affluent middle class keen to enjoy the branded products found in the more developed states of Europe and North America.

Consumer trends

Product variety continues to grow globally with more need for product ranges and clear shelf differentiation for products. Consumer habits are also evolving with more focus on convenience and portion control.

People are living longer with busy lifestyles, which is clearly a driver for this convenience.

There is also an increasing movement towards more sustainable solutions in both product and packaging choices.

The Future of Flexographic Printing Markets to 2023 provides a five year forecast for this dynamic sector. Download the report brochure.

This article was written with the help of Neil Shackleton, a print specialist working with Smithers.