Market Report

Natural and Synthetic Rubber for Non-Tire Applications to 2023

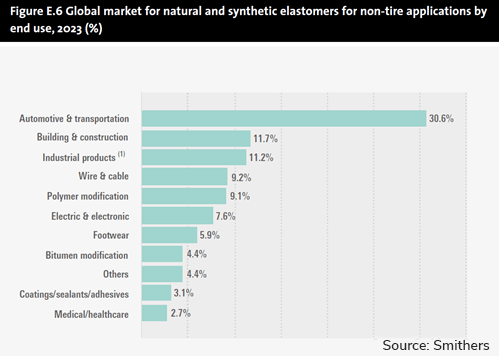

While the global non-tire elastomer market is considerably smaller than the global tires market, it is far broader in both the number and the type of applications. While tire applications require a relatively small range of rubbers to execute the needs of the tire-producing industries, the non-tire industry is characterised by a wide number of elastomers currently in use, many of which find no place in the production of tires.

The main driver for elastomers is the demand for increased performance. Improvements are needed in heat resistance, chemical resistance and, in many cases, improved compression set. Smithers identifies four key areas that will assist in meeting this demand.

Versalis, Italy and Bridgestone Americas have signed an agreement to commercialise natural rubber derived from the guayule shrub. The agreement will enable Versalis and Bridgestone to focus on development of proprietary highly productive varieties of guayule using cutting-edge genetic technologies.

While this development is focused on the production of natural rubber for tires, it is evident that non-tire applications in both Europe and the US will benefit from these initiatives.

The European Union set up a programme some time ago to develop production of guayule, principally for surgical gloves. No concrete results are to be expected until at least 2020, but it is expected that other companies and organisations will also take the initiative to develop non-Asian natural rubber. The driving forces here are to obtain independence of supply for Europe and the US.

Unlike paper and cardboard, which are able to replace plastics in certain applications, rubbers cannot be replaced by any known substances. There is, of course, inter-competition.

For example, solution styrene-butadiene rubber (SBR) has almost replaced emulsion SBR in many automotive tire applications. There is now evidence that it will begin to replace emulsion SBR in a number of non-tire applications, due to its better abrasion resistance, superior flexibility and enhanced deformation recovery.

The rapid emergence of polyolefin elastomers (POE) is causing some concern to suppliers of ethylene propylene diene monomer (EPDM) rubber, since they are now replacing EPDM for a number of applications. They have excellent low-temperature properties and the olefin block copolymers (OBC) are beginning to replace EPDM in thermoplastic elestomers (TPEs).

The most important regulation put into European law is Regulation 1907/2006 for the Registration, Evaluation, Authorisation and restriction of Chemicals (REACH). The regulation requires a list to be compiled of all chemical substances used or likely to be used in the production of plastics and rubbers.

A recent problem has occurred in Germany, in respect to the use of rubber in the production of hoses for the use of drinking water. It appears that vulcanised elastomers are likely to be banned by the German authorities for this application, due to the fact that they contain Substances of Very High Concern (SVHCs) as defined by REACH.

While REACH is a purely European Union regulation, it is very likely to have knock-on impacts on multiple types of rubber goods imported into Europe. Just as the global nature of tire trade – with trans-regional imports and exports – means that EU tire labelling regulations have a strong influence on that global industry.

Vulcanised rubbers suffer from the drawback that they require extended curing process methods time to achieve their desired properties. This limitation has been accepted for many years, because the advantages of the properties of rubber compounds outweigh their disadvantages. The introduction of thermoplastic elastomers,(which require no vulcanisation, has sharpened the need for more efficient rubber component production processes.

For technical reasons, the vulcanisation of rubber compounds cannot be accelerated so as to match the comparatively short cycles of thermoplastic processing. These problems have been addressed by on-line vulcanisation and by extending the process or adding a post-curing oven to the production line.

The Future of Natural and Synthetic Rubber for Non-Tire Applications to 2023 offers you an in-depth analysis of the non-tire application market by elastomer, application and region. Dowload the brochure for more information.